irs child tax credit tool

The Child Tax Credit for tax year 2021 is up. IRS Resources and Guidance Includes e-posters in other languages user.

Irs Launches New Tool To Get Child Tax Credit Payments To Non Filers

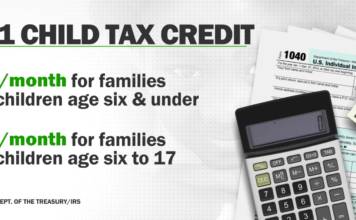

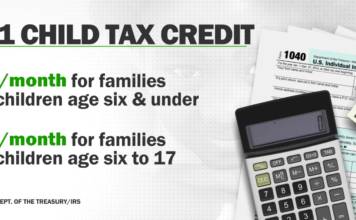

The payments are part of the American Rescue Plan a 19 trillion package that increased the 2021 child tax credit from 2000 to 3600.

. The IRS began issuing advance payments of the Child Tax Credit CTC in mid-July. This is up from the existing credit of up to 2000 per child under. These two tools follow the Non-Filer Sign-Up Tool launched earlier this month.

WASHINGTON The Internal Revenue Service has launched a new Spanish-language version of its online tool Child Tax Credit Eligibility. An online tool for taxpayers who dont normally file tax returns has been updated to provide the IRS with information to claim the 2021 Child Tax Credit. The agency also unveiled a non-filer tool last week which allows families who dont normally file taxes to enroll.

Use our simplified tax filing tool to claim your Child Tax Credit Earned Income Tax Credit and any missing amount of your third stimulus payment. The Child Tax Credit Update Portal is no longer available. The total changes to 3000 per child for parents of six to 17 year olds or 250 per month and 1500 at tax time.

Families receiving child tax credit payments have until tonight to inform the IRS of any significant income changes for those changes to be reflected in the payment coming. Theres a Child Tax Credit Eligibility Assistant tool and a child Tax Credit Update Portal. This new tool is accessible just on IRSgov.

IR-2021-133 June 24 2021 The Treasury Department and the IRS today urged families to take advantage of a special online tool that can help them determine whether they. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021. Form 1040 1040-SR or 1040-NR line 3a Qualified dividends -- 06-APR-2021.

Child Tax Credit Eligibility Assistant helps families determine whether they qualify for Child Tax Credit payments Update Portal helps families monitor and manage Child Tax. The enhanced credit gives families up to 3600 for each child under 6 and 3000 for each one under age 18. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

IR-2021-150 July 12 2021. Similar to certain other credits with an advance payment option taxpayers who receive. Families who guarantee the Child Tax Credit for 2021 will get up to 3000 per qualifying child who is somewhere in the range of 6 and 17 years of.

The IRS urges families to use a special online tool available only on IRSgov to help them determine whether they qualify for the child tax credit and the special monthly advance. IRS Child Tax Credit Non-filer Sign-up Tool Helps you report qualifying children born before 2021. The IRS has launched an online tool to help low-income families register for monthly child tax credit payments.

The payments are part of a 2021 expansion to the existing Child. The Internal Revenue Service IRS has released two online tools to help families with the new monthly child tax credit payments that are part of the 19 trillion third stimulus. The bill also allowed families the.

But it doesnt work on mobile devices which advocacy. Face masks and other personal protective equipment to prevent the spread of COVID-19 are tax deductible. The IRS will make a one-time payment of 500 for dependents.

Irs 2 New Online Tools Available To Help Manage Child Tax Credit Khou Com

Irs Child Tax Credit Scam Arrives As Payouts Hit Bank Accounts

Child Tax Credit Portal Update New Non Filer Sign Up Tool 2021

Stimulus Update When Will Next Child Tax Credit Payment Arrive Irs Launches New Tool Al Com

Advance Child Tax Credit Short Or Missing Navigate Housing

Tas Tax Tip Check Out These Advance Child Tax Credit Tools Tas

How You Can Claim Your Child Tax Credit Money Using Irs New Tracking Tool The Us Sun

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Child Tax Credit Irs Launches 2 Online Tools To Answer Eligibility Questions

Irsnews On Twitter Irs Offers The Child Tax Credit Eligibility Assistant In English And Spanish This Interactive Tool Can Help Your Family Determine Whether You Qualify For The Childtaxcredit See Https T Co 535gr8o86p Hhm

Child Tax Credit Eligibility Tool Now Available In Spanish Irs Says Nj Com

Child Tax Credit Tool Reopens For Families Missing Payments Ktla

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Child Tax Credit 2021 This Is The Last Day To Opt Out Of Payments Fox Business

Crosslink Professional Tax Solutions The Irs Has Released Their New Online Tool For Those Families Choosing To Opt Out Of The Monthly Advance Payments For The Child Tax Credit Learn More

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Sign Up For Child Tax Credit As A Tax Non Filer

Here S What You Need To Know About Child Tax Credit Payments The Washington Post